Page 41 - Q4-2024-EN

P. 41

AL-MAZAYA HOLDING COMPANY - K.S.C. (PUBLIC)

AND ITS SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2023

(All amounts are in Kuwaiti Dinars)

Net realizable value for properties held for trading is based on valuations performed by independent valuers in

compliance with the Executive Regulations of Capital Markets Authority regarding the valuation of real estate properties.

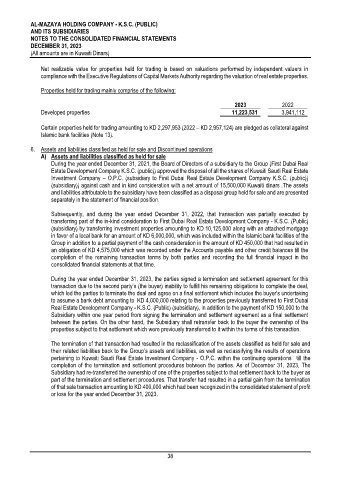

Properties held for trading mainly comprise of the following:

2023 2022

Developed properties 11,223,531 3,941,112

Certain properties held for trading amounting to KD 2,297,953 (2022 – KD 2,957,124) are pledged as collateral against

Islamic bank facilities (Note 13).

6. Assets and liabilities classified as held for sale and Discontinued operations

A) Assets and liabilities classified as held for sale

During the year ended December 31, 2021, the Board of Directors of a subsidiary to the Group (First Dubai Real

Estate Development Company K.S.C. (public)) approved the disposal of all the shares of Kuwaiti Saudi Real Estate

Investment Company – O.P.C. (subsidiary to First Dubai Real Estate Development Company K.S.C. (public))

(subsidiary)) against cash and in kind consideration with a net amount of 15,500,000 Kuwaiti dinars .The assets

and liabilities attributable to the subsidiary have been classified as a disposal group held for sale and are presented

separately in the statement of financial position.

Subsequently, and during the year ended December 31, 2022, that transaction was partially executed by

transferring part of the in-kind consideration to First Dubai Real Estate Development Company - K.S.C. (Public)

(subsidiary) by transferring investment properties amounting to KD 10,125,000 along with an attached mortgage

in favor of a local bank for an amount of KD 6,000,000, which was included within the Islamic bank facilities of the

Group in addition to a partial payment of the cash consideration in the amount of KD 450,000 that had resulted in

an obligation of KD 4,575,000 which was recorded under the Accounts payable and other credit balances till the

completion of the remaining transaction terms by both parties and recording the full financial impact in the

consolidated financial statements at that time.

During the year ended December 31, 2023, the parties signed a termination and settlement agreement for this

transaction due to the second party’s (the buyer) inability to fulfill his remaining obligations to complete the deal,

which led the parties to terminate the deal and agree on a final settlement which includes the buyer’s undertaking

to assume a bank debt amounting to KD 4,000,000 relating to the properties previously transferred to First Dubai

Real Estate Development Company - K.S.C. (Public) (subsidiary), in addition to the payment of KD 150,000 to the

Subsidiary within one year period from signing the termination and settlement agreement as a final settlement

between the parties. On the other hand, the Subsidiary shall retransfer back to the buyer the ownership of the

properties subject to that settlement which were previously transferred to it within the terms of this transaction.

The termination of that transaction had resulted in the reclassification of the assets classified as held for sale and

their related liabilities back to the Group’s assets and liabilities, as well as reclassifying the results of operations

pertaining to Kuwaiti Saudi Real Estate Investment Company - O.P.C. within the continuing operations till the

completion of the termination and settlement procedures between the parties. As of December 31, 2023, The

Subsidiary had re-transferred the ownership of one of the properties subject to that settlement back to the buyer as

part of the termination and settlement procedures. That transfer had resulted in a partial gain from the termination

of that sale transaction amounting to KD 400,000 which had been recognized in the consolidated statement of profit

or loss for the year ended December 31, 2023.

38