Page 46 - Q4-2024-EN

P. 46

AL-MAZAYA HOLDING COMPANY - K.S.C. (PUBLIC)

AND ITS SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2023

(All amounts are in Kuwaiti Dinars)

a) During the year ended December 31, 2022, the Group transferred net right of use real estate assets amounting KD

62,115 from investment properties to property, plant and equipment, as these properties are used in the activity by

one of the subsidiaries (Note 9).

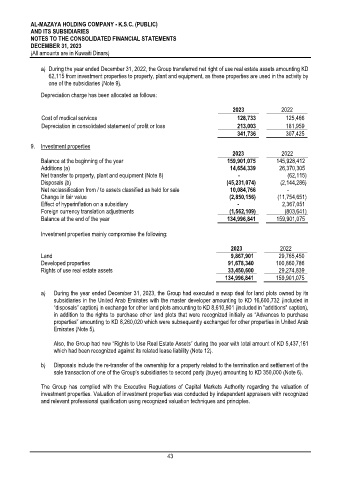

Depreciation charge has been allocated as follows:

2023 2022

Cost of medical services 128,733 125,466

Depreciation in consolidated statement of profit or loss 213,003 181,959

341,736 307,425

9. Investment properties

2023 2022

Balance at the beginning of the year 159,901,075 145,928,412

Additions (a) 14,654,339 26,370,305

Net transfer to property, plant and equipment (Note 8) - (62,115)

Disposals (b) (45,231,074) (2,144,286)

Net reclassification from / to assets classified as held for sale 10,084,766 -

Change in fair value (2,850,156) (11,754,651)

Effect of hyperinflation on a subsidiary - 2,367,051

Foreign currency translation adjustments (1,562,109) (803,641)

Balance at the end of the year 134,996,841 159,901,075

Investment properties mainly compromise the following:

2023 2022

Land 9,867,901 29,765,450

Developed properties 91,678,340 100,860,786

Rights of use real estate assets 33,450,600 29,274,839

134,996,841 159,901,075

a) During the year ended December 31, 2023, the Group had executed a swap deal for land plots owned by its

subsidiaries in the United Arab Emirates with the master developer amounting to KD 16,600,732 (included in

“disposals” caption) in exchange for other land plots amounting to KD 8,610,901 (included in "additions" caption),

in addition to the rights to purchase other land plots that were recognized initially as “Advances to purchase

properties” amounting to KD 8,260,020 which were subsequently exchanged for other properties in United Arab

Emirates (Note 5).

Also, the Group had new “Rights to Use Real Estate Assets” during the year with total amount of KD 5,437,161

which had been recognized against its related lease liability (Note 12).

b) Disposals include the re-transfer of the ownership for a property related to the termination and settlement of the

sale transaction of one of the Group’s subsidiaries to second party (buyer) amounting to KD 350,000 (Note 6).

The Group has complied with the Executive Regulations of Capital Markets Authority regarding the valuation of

investment properties. Valuation of investment properties was conducted by independent appraisers with recognized

and relevant professional qualification using recognized valuation techniques and principles.

43