Page 51 - Q4-2024-EN

P. 51

AL-MAZAYA HOLDING COMPANY - K.S.C. (PUBLIC)

AND ITS SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2023

(All amounts are in Kuwaiti Dinars)

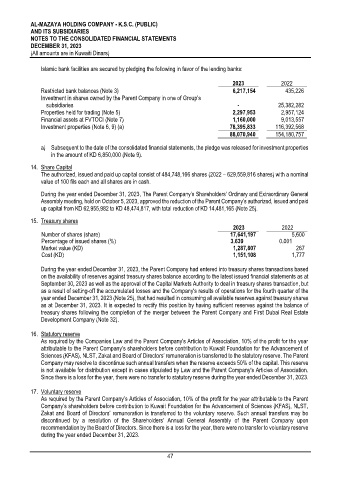

Islamic bank facilities are secured by pledging the following in favor of the lending banks:

2023 2022

Restricted bank balances (Note 3) 6,217,154 435,226

Investment in shares owned by the Parent Company in one of Group’s

subsidiaries - 25,382,282

Properties held for trading (Note 5) 2,297,953 2,957,124

Financial assets at FVTOCI (Note 7) 1,160,000 9,013,557

Investment properties (Note 6, 9) (a) 78,395,833 116,392,568

88,070,940 154,180,757

a) Subsequent to the date of the consolidated financial statements, the pledge was released for investment properties

in the amount of KD 6,850,000 (Note 9).

14. Share Capital

The authorized, issued and paid up capital consist of 484,748,166 shares (2022 – 629,559,816 shares) with a nominal

value of 100 fils each and all shares are in cash.

During the year ended December 31, 2023, The Parent Company’s Shareholders’ Ordinary and Extraordinary General

Assembly meeting, held on October 5, 2023, approved the reduction of the Parent Company’s authorized, issued and paid

up capital from KD 62,955,982 to KD 48,474,817, with total reduction of KD 14,481,165 (Note 25).

15. Treasury shares

2023 2022

Number of shares (share) 17,641,197 5,600

Percentage of issued shares (%) 3.639 0.001

Market value (KD) 1,287,807 267

Cost (KD) 1,151,108 1,777

During the year ended December 31, 2023, the Parent Company had entered into treasury shares transactions based

on the availability of reserves against treasury shares balance according to the latest issued financial statements as at

September 30, 2023 as well as the approval of the Capital Markets Authority to deal in treasury shares transaction, but

as a result of setting-off the accumulated losses and the Company's results of operations for the fourth quarter of the

year ended December 31, 2023 (Note 25), that had resulted in consuming all available reserves against treasury shares

as at December 31, 2023. It is expected to rectify this position by having sufficient reserves against the balance of

treasury shares following the completion of the merger between the Parent Company and First Dubai Real Estate

Development Company (Note 32).

16. Statutory reserve

As required by the Companies Law and the Parent Company's Articles of Association, 10% of the profit for the year

attributable to the Parent Company’s shareholders before contribution to Kuwait Foundation for the Advancement of

Sciences (KFAS), NLST, Zakat and Board of Directors’ remuneration is transferred to the statutory reserve. The Parent

Company may resolve to discontinue such annual transfers when the reserve exceeds 50% of the capital. This reserve

is not available for distribution except in cases stipulated by Law and the Parent Company's Articles of Association.

Since there is a loss for the year, there were no transfer to statutory reserve during the year ended December 31, 2023.

17. Voluntary reserve

As required by the Parent Company’s Articles of Association, 10% of the profit for the year attributable to the Parent

Company’s shareholders before contribution to Kuwait Foundation for the Advancement of Sciences (KFAS), NLST,

Zakat and Board of Directors’ remuneration is transferred to the voluntary reserve. Such annual transfers may be

discontinued by a resolution of the Shareholders’ Annual General Assembly of the Parent Company upon

recommendation by the Board of Directors. Since there is a loss for the year, there were no transfer to voluntary reserve

during the year ended December 31, 2023.

47