Page 53 - Q4-2024-EN

P. 53

AL-MAZAYA HOLDING COMPANY - K.S.C. (PUBLIC)

AND ITS SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2023

(All amounts are in Kuwaiti Dinars)

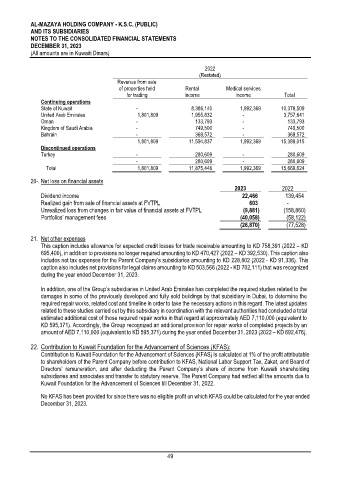

2022

(Restated)

Revenue from sale

of properties held Rental Medical services

for trading Income income Total

Continuing operations

State of Kuwait - 8,386,140 1,992,369 10,378,509

United Arab Emirates 1,801,809 1,955,832 - 3,757,641

Oman - 133,793 - 133,793

Kingdom of Saudi Arabia - 749,500 - 749,500

Bahrain - 369,572 - 369,572

1,801,809 11,594,837 1,992,369 15,389,015

Discontinued operations

Turkey - 280,609 - 280,609

- 280,609 - 280,609

Total 1,801,809 11,875,446 1,992,369 15,669,624

20-. Net loss on financial assets

2023 2022

Dividend income 22,466 139,454

Realized gain from sale of financial assets at FVTPL 603 -

Unrealized loss from changes in fair value of financial assets at FVTPL (9,881) (158,860)

Portfolios’ management fees (40,058) (58,122)

(26,870) (77,528)

21. Net other expenses

This caption includes allowance for expected credit losses for trade receivable amounting to KD 758,391 (2022 – KD

695,400), in addition to provisions no longer required amounting to KD 470,427 (2022 – KD 392,530). This caption also

includes net tax expenses for the Parent Company’s subsidiaries amounting to KD 228,802 (2022 - KD 91,336). This

caption also includes net provisions for legal claims amounting to KD 503,566 (2022 - KD 702,111) that was recognized

during the year ended December 31, 2023.

In addition, one of the Group’s subsidiaries in United Arab Emirates has completed the required studies related to the

damages in some of the previously developed and fully sold buildings by that subsidiary in Dubai, to determine the

required repair works, related cost and timeline in order to take the necessary actions in this regard. The latest updates

related to these studies carried out by this subsidiary in coordination with the relevant authorities had concluded a total

estimated additional cost of those required repair works in that regard at approximately AED 7,110,000 (equivalent to

KD 595,371). Accordingly, the Group recognized an additional provision for repair works of completed projects by an

amount of AED 7,110,000 (equivalent to KD 595,371) during the year ended December 31, 2023 (2022 – KD 692,476).

22. Contribution to Kuwait Foundation for the Advancement of Sciences (KFAS):

Contribution to Kuwait Foundation for the Advancement of Sciences (KFAS) is calculated at 1% of the profit attributable

to shareholders of the Parent Company before contribution to KFAS, National Labor Support Tax, Zakat, and Board of

Directors’ remuneration, and after deducting the Parent Company’s share of income from Kuwaiti shareholding

subsidiaries and associates and transfer to statutory reserve. The Parent Company had settled all the amounts due to

Kuwait Foundation for the Advancement of Sciences till December 31, 2022.

No KFAS has been provided for since there was no eligible profit on which KFAS could be calculated for the year ended

December 31, 2023.

49