Page 57 - Q4-2024-EN

P. 57

AL-MAZAYA HOLDING COMPANY - K.S.C. (PUBLIC)

AND ITS SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2023

(All amounts are in Kuwaiti Dinars)

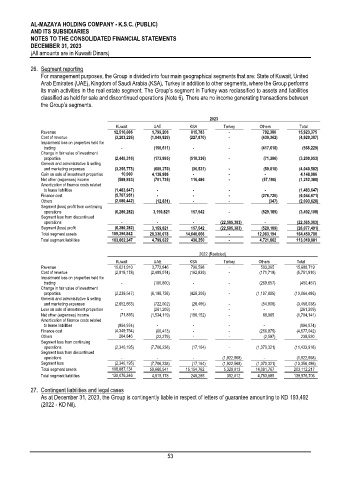

26. Segment reporting

For management purposes, the Group is divided into four main geographical segments that are: State of Kuwait, United

Arab Emirates (UAE), Kingdom of Saudi Arabia (KSA), Turkey in addition to other segments, where the Group performs

its main activities in the real estate segment. The Group’s segment in Turkey was reclassified to assets and liabilities

classified as held for sale and discontinued operations (Note 6). There are no income generating transactions between

the Group’s segments.

2023

Kuwait UAE KSA Turkey Others Total

Revenue 12,516,006 1,799,206 815,783 - 792,380 15,923,375

Cost of revenue (3,203,226) (1,049,929) (227,870) - (439,362) (4,920,387)

Impairment loss on properties held for

trading - (150,611) - - (417,618) (568,229)

Change in fair value of investment

properties (2,445,316) (173,995) (510,336) - (71,306) (3,200,953)

General and administrative & selling

and marketing expenses (3,255,773) (689,270) (36,521) - (59,018) (4,040,582)

Gain on sale of investment properties 10,000 4,138,986 - - - 4,148,986

Net other (expenses) income (569,933) (701,735) 116,486 - (57,198) (1,212,380)

Amortization of finance costs related

to lease liabilities (1,483,647) - - - - (1,483,647)

Finance cost (5,767,951) - - - (276,720) (6,044,671)

Others (2,080,442) (12,831) - - (347) (2,093,620)

Segment (loss) profit from continuing

operations (6,280,282) 3,159,821 157,542 - (529,189) (3,492,108)

Segment loss from discontinued

operations - - - (22,585,383) - (22,585,383)

Segment (loss) profit (6,280,282) 3,159,821 157,542 (22,585,383) (529,189) (26,077,491)

Total segment assets 109,396,842 28,330,078 14,640,666 - 12,083,194 164,450,780

Total segment liabilities 103,062,347 4,799,622 436,250 - 4,721,662 113,019,881

2022 (Restated)

Kuwait UAE KSA Turkey Others Total

Revenue 10,621,910 3,772,846 790,598 - 503,365 15,688,719

Cost of revenue (2,918,178) (2,499,074) (162,839) - (171,719) (5,751,810)

Impairment loss on properties held for

trading - (180,800) - - (269,657) (450,457)

Change in fair value of investment

properties (2,239,547) (6,198,738) (428,306) - (1,197,895) (10,064,486)

General and administrative & selling

and marketing expenses (2,652,663) (722,002) (28,465) - (54,908) (3,458,038)

Loss on sale of investment properties - (261,209) - - - (261,209)

Net other (expenses) income (71,835) (1,534,119) (188,152) - 89,965 (1,704,141)

Amortization of finance costs related

to lease liabilities (994,974) - - - - (994,974)

Finance cost (4,349,754) (60,413) - - (266,875) (4,677,042)

Others 264,846 (22,279) - - (2,597) 239,520

Segment loss from continuing

operations (2,340,195) (7,706,238) (17,164) - (1,370,321) (11,433,918)

Segment loss from discontinued

operations - - - (1,922,568) - (1,922,568)

Segment loss (2,340,195) (7,706,238) (17,164) (1,922,568) (1,370,321) (13,356,486)

Total segment assets 108,887,134 59,660,541 15,154,762 5,328,013 14,081,767 203,112,217

Total segment liabilities 130,076,346 4,515,178 248,285 352,012 4,783,885 139,975,706

27. Contingent liabilities and legal cases

As at December 31, 2023, the Group is contingently liable in respect of letters of guarantee amounting to KD 193,492

(2022 - KD Nil).

53