Page 60 - Q4-2024-EN

P. 60

AL-MAZAYA HOLDING COMPANY - K.S.C. (PUBLIC)

AND ITS SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2023

(All amounts are in Kuwaiti Dinars)

b) Credit risk

Credit risk is the risk that one party to a financial instrument will fail to discharge a contractual obligation causing

the other party to incur a financial loss. Financial assets which potentially subject the Group to credit risk consist

principally of cash and cash equivalent and receivables. The Group’s cash is placed with high credit rating financial

institutions. Receivables is presented net of allowance for expected credit losses.

Cash and cash equivalent

The Group’s cash and cash equivalent measured at amortized cost are considered to have a low credit risk and

the loss allowance is based on the 12 months expected loss. The Group's cash and cash equivalent are placed

with high credit rating financial institutions with no recent history of default. Based on management’s assessment,

the expected credit loss impact arising from such financial assets are insignificant to the Group as the risk of default

has not increased significantly since initial recognition.

Accounts receivable

The Group’s exposure to credit risk is influenced mainly by the individual characteristics of each customer. The

demographics of the Group’s customer base, including the default risk of activities and country, in which customers

operate, has less of an influence on credit risk.

Customer credit risk is managed by each business unit subject to the Group’s established policy, procedures and

control relating to customer credit risk management. Outstanding customer receivables are regularly monitored.

The Group’s maximum exposure arising from default of the counterparty is limited to the carrying amount of cash

and cash equivalents and receivables.

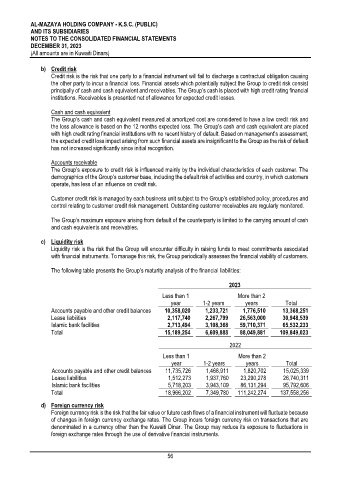

c) Liquidity risk

Liquidity risk is the risk that the Group will encounter difficulty in raising funds to meet commitments associated

with financial instruments. To manage this risk, the Group periodically assesses the financial viability of customers.

The following table presents the Group’s maturity analysis of the financial liabilities:

2023

Less than 1 More than 2

year 1-2 years years Total

Accounts payable and other credit balances 10,358,020 1,233,721 1,776,510 13,368,251

Lease liabilities 2,117,740 2,267,799 26,563,000 30,948,539

Islamic bank facilities 2,713,494 3,108,368 59,710,371 65,532,233

Total 15,189,254 6,609,888 88,049,881 109,849,023

2022

Less than 1 More than 2

year 1-2 years years Total

Accounts payable and other credit balances 11,735,726 1,468,911 1,820,702 15,025,339

Lease liabilities 1,512,273 1,937,760 23,290,278 26,740,311

Islamic bank facilities 5,718,203 3,943,109 86,131,294 95,792,606

Total 18,966,202 7,349,780 111,242,274 137,558,256

d) Foreign currency risk

Foreign currency risk is the risk that the fair value or future cash flows of a financial instrument will fluctuate because

of changes in foreign currency exchange rates. The Group incurs foreign currency risk on transactions that are

denominated in a currency other than the Kuwaiti Dinar. The Group may reduce its exposure to fluctuations in

foreign exchange rates through the use of derivative financial instruments.

56