Page 62 - Q4-2024-EN

P. 62

AL-MAZAYA HOLDING COMPANY - K.S.C. (PUBLIC)

AND ITS SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2023

(All amounts are in Kuwaiti Dinars)

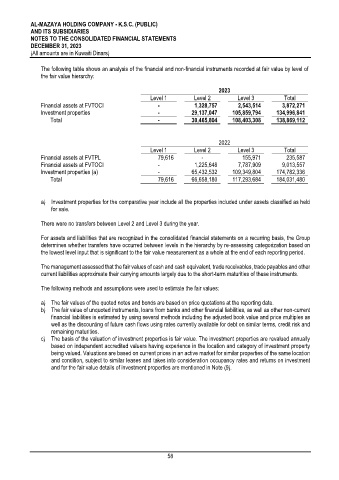

The following table shows an analysis of the financial and non-financial instruments recorded at fair value by level of

the fair value hierarchy:

2023

Level 1 Level 2 Level 3 Total

Financial assets at FVTOCI - 1,328,757 2,543,514 3,872,271

Investment properties - 29,137,047 105,859,794 134,996,841

Total - 30,465,804 108,403,308 138,869,112

2022

Level 1 Level 2 Level 3 Total

Financial assets at FVTPL 79,616 - 155,971 235,587

Financial assets at FVTOCI - 1,225,648 7,787,909 9,013,557

Investment properties (a) - 65,432,532 109,349,804 174,782,336

Total 79,616 66,658,180 117,293,684 184,031,480

a) Investment properties for the comparative year include all the properties included under assets classified as held

for sale.

There were no transfers between Level 2 and Level 3 during the year.

For assets and liabilities that are recognized in the consolidated financial statements on a recurring basis, the Group

determines whether transfers have occurred between levels in the hierarchy by re-assessing categorization based on

the lowest level input that is significant to the fair value measurement as a whole at the end of each reporting period.

The management assessed that the fair values of cash and cash equivalent, trade receivables, trade payables and other

current liabilities approximate their carrying amounts largely due to the short-term maturities of these instruments.

The following methods and assumptions were used to estimate the fair values:

a) The fair values of the quoted notes and bonds are based on price quotations at the reporting date.

b) The fair value of unquoted instruments, loans from banks and other financial liabilities, as well as other non-current

financial liabilities is estimated by using several methods including the adjusted book value and price multiples as

well as the discounting of future cash flows using rates currently available for debt on similar terms, credit risk and

remaining maturities.

c) The basis of the valuation of investment properties is fair value. The investment properties are revalued annually

based on independent accredited valuers having experience in the location and category of investment property

being valued. Valuations are based on current prices in an active market for similar properties of the same location

and condition, subject to similar leases and takes into consideration occupancy rates and returns on investment

and for the fair value details of investment properties are mentioned in Note (9).

58