Page 61 - Q4-2024-EN

P. 61

AL-MAZAYA HOLDING COMPANY - K.S.C. (PUBLIC)

AND ITS SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2023

(All amounts are in Kuwaiti Dinars)

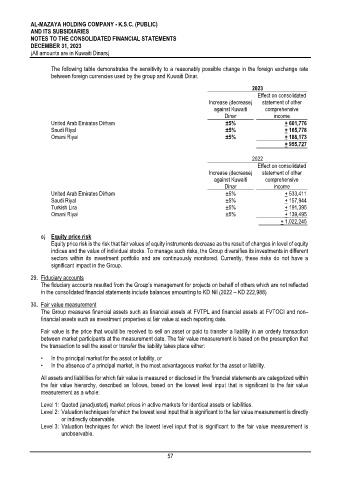

The following table demonstrates the sensitivity to a reasonably possible change in the foreign exchange rate

between foreign currencies used by the group and Kuwaiti Dinar.

2023

Effect on consolidated

Increase (decrease) statement of other

against Kuwaiti comprehensive

Dinar income

United Arab Emirates Dirham ±5% + 601,776

Saudi Riyal ±5% + 165,778

Omani Riyal ±5% + 188,173

+ 955,727

2022

Effect on consolidated

Increase (decrease) statement of other

against Kuwaiti comprehensive

Dinar income

United Arab Emirates Dirham ±5% + 533,411

Saudi Riyal ±5% + 157,944

Turkish Lira ±5% + 191,395

Omani Riyal ±5% + 139,495

+ 1,022,245

e) Equity price risk

Equity price risk is the risk that fair values of equity instruments decrease as the result of changes in level of equity

indices and the value of individual stocks. To manage such risks, the Group diversifies its investments in different

sectors within its investment portfolio and are continuously monitored. Currently, these risks do not have a

significant impact in the Group.

29. Fiduciary accounts

The fiduciary accounts resulted from the Group’s management for projects on behalf of others which are not reflected

in the consolidated financial statements include balances amounting to KD Nil (2022 – KD 222,988)

30. Fair value measurement

The Group measures financial assets such as financial assets at FVTPL and financial assets at FVTOCI and non–

financial assets such as investment properties at fair value at each reporting date.

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction

between market participants at the measurement date. The fair value measurement is based on the presumption that

the transaction to sell the asset or transfer the liability takes place either:

• In the principal market for the asset or liability, or

• In the absence of a principal market, in the most advantageous market for the asset or liability.

All assets and liabilities for which fair value is measured or disclosed in the financial statements are categorized within

the fair value hierarchy, described as follows, based on the lowest level input that is significant to the fair value

measurement as a whole:

Level 1: Quoted (unadjusted) market prices in active markets for identical assets or liabilities.

Level 2: Valuation techniques for which the lowest level input that is significant to the fair value measurement is directly

or indirectly observable.

Level 3: Valuation techniques for which the lowest level input that is significant to the fair value measurement is

unobservable.

57