Page 64 - Q4-2024-EN

P. 64

AL-MAZAYA HOLDING COMPANY - K.S.C. (PUBLIC)

AND ITS SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2023

(All amounts are in Kuwaiti Dinars)

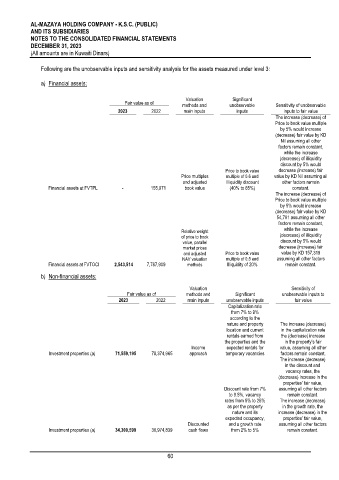

Following are the unobservable inputs and sensitivity analysis for the assets measured under level 3:

a) Financial assets:

Valuation Significant

Fair value as of methods and unobservable Sensitivity of unobservable

2023 2022 main inputs inputs inputs to fair value

The increase (decrease) of

Price to book value multiple

by 5% would increase

(decrease) fair value by KD

Nil assuming all other

factors remain constant,

while the increase

(decrease) of illiquidity

discount by 5% would

Price to book value decrease (increase) fair

Price multiples multiple of 0.6 and value by KD Nil assuming all

and adjusted Illiquidity discount other factors remain

Financial assets at FVTPL - 155,971 book value (40% to 65%) constant.

The increase (decrease) of

Price to book value multiple

by 5% would increase

(decrease) fair value by KD

54,701 assuming all other

factors remain constant,

Relative weight while the increase

of price to book (decrease) of illiquidity

value, parallel discount by 5% would

market prices decrease (increase) fair

and adjusted Price to book value value by KD 157,319

NAV valuation multiple of 0.5 and assuming all other factors

Financial assets at FVTOCI 2,543,514 7,787,909 methods Illiquidity of 20% remain constant.

b) Non-financial assets:

Valuation Sensitivity of

Fair value as of methods and Significant unobservable inputs to

2023 2022 main inputs unobservable inputs fair value

Capitalization rate

from 7% to 9%

according to the

nature and property The increase (decrease)

location and current in the capitalization rate

rentals earned from the (decrease) increase

the properties and the in the property’s fair

Income expected rentals for value, assuming all other

Investment properties (a) 71,559,195 78,374,965 approach temporary vacancies factors remain constant.

The increase (decrease)

in the discount and

vacancy rates, the

(decrease) increase in the

properties’ fair value,

Discount rate from 7% assuming all other factors

to 9.5%, vacancy remain constant.

rates from 5% to 25% The increase (decrease)

as per the property in the growth rate, the

nature and its increase (decrease) in the

expected occupancy, properties’ fair value,

Discounted and a growth rate assuming all other factors

Investment properties (a) 34,300,599 30,974,839 cash flows from 2% to 5% remain constant.

60