Page 59 - Q4-2024-EN

P. 59

AL-MAZAYA HOLDING COMPANY - K.S.C. (PUBLIC)

AND ITS SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2023

(All amounts are in Kuwaiti Dinars)

A subsidiary to the Parent Company in the Emirate of Dubai had filed a lawsuit (as a precautionary measure in order to

avoid the statute of limitation related to the date of filing that lawsuit) against several parties demanding them to be bear

the costs of rectifying the defects and repairing some buildings in the Emirate of Dubai that they had previously

developed for the benefit of the subsidiary during the period from 2007 to 2015, due to their responsibility for the

implementation work and supervising the implementation of those buildings for the benefit of the subsidiary as some

defects that require repairs had appeared according to the reports of relevant authorities in the Emirate of Dubai, where

the Company demands to oblige the defendants with a total amount of AED 82,022,600 (equivalent to KD 6,868,333)

in addition to the legal interest of 5% from the date of the judicial claim till full settlement date, in addition to demanding

that some of the other defendants be obligated to an amount of AED 23,200,000 in solidarity with the first defendant

parties (equivalent to the amount of KD 1,942,700) in addition to the legal interest of 5% from the date of the judicial

claim till full settlement date, which represents the estimated budget of the repair costs for the subject buildings that

resulted from implementation defects by the main contractor and subcontractors in addition to reserving the right to

request compensation after assessing the damages and losses as well as obliging the defendants to pay the related

fees, expenses, and attorney’s fees. This case is still currently under hearing in front of the legal courts as of the

accompanying consolidated financial statements date. In the same regard, there are some legal claims raised against

that subsidiary by some owners of the units in those buildings under repair requesting the cancellation of their contracts

and compensation for damages, where the independent legal counsel believes that the company has the full right to

claim all those damages and compensations with recourse against all parties responsible for the development and

implementation works for those buildings in case of any negative ruling against the company, which is the same subject

matter of the aforementioned legal case. In addition, the Court of First Instance had ruled in some of those legal cases

in the favor of that subsidiary, where the cases are still currently under hearing in front of the legal courts, and hence,

no provisions were booked against those legal cases as of the date of the accompanying consolidated financial

statements.

28. Financial risk management

In the normal course of business, the Group uses primary financial instruments such as cash and cash equivalents,

financial assets at FVTPL, accounts receivable, financial assets at FVTOCI, accounts payable, lease liabilities and

Islamic bank facilities and as a result, is exposed to the risks indicated below. The Group currently does not use

derivative financial instruments to manage its exposure to these risks.

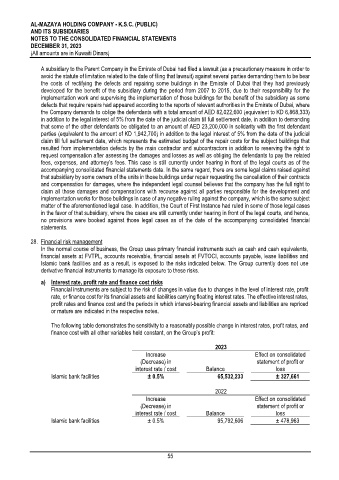

a) Interest rate, profit rate and finance cost risks

Financial instruments are subject to the risk of changes in value due to changes in the level of interest rate, profit

rate, or finance cost for its financial assets and liabilities carrying floating interest rates. The effective interest rates,

profit rates and finance cost and the periods in which interest-bearing financial assets and liabilities are repriced

or mature are indicated in the respective notes.

The following table demonstrates the sensitivity to a reasonably possible change in interest rates, profit rates, and

finance cost with all other variables held constant, on the Group’s profit:

2023

Increase Effect on consolidated

(Decrease) in statement of profit or

interest rate / cost Balance loss

Islamic bank facilities ± 0.5% 65,532,233 ± 327,661

2022

Increase Effect on consolidated

(Decrease) in statement of profit or

interest rate / cost Balance loss

Islamic bank facilities ± 0.5% 95,792,606 ± 478,963

55