Page 55 - Q4-2024-EN

P. 55

AL-MAZAYA HOLDING COMPANY - K.S.C. (PUBLIC)

AND ITS SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2023

(All amounts are in Kuwaiti Dinars)

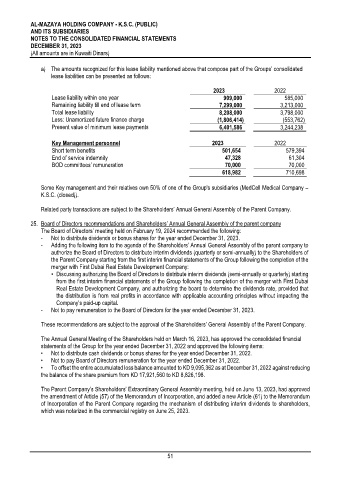

a) The amounts recognized for this lease liability mentioned above that compose part of the Groups’ consolidated

lease liabilities can be presented as follows:

2023 2022

Lease liability within one year 909,000 585,000

Remaining liability till end of lease term 7,299,000 3,213,000

Total lease liability 8,208,000 3,798,000

Less: Unamortized future finance charge (1,806,414) (553,762)

Present value of minimum lease payments 6,401,586 3,244,238

Key Management personnel 2023 2022

Short term benefits 501,654 579,394

End of service indemnity 47,328 61,304

BOD committees’ remuneration 70,000 70,000

618,982 710,698

Some Key management and their relatives own 50% of one of the Group's subsidiaries (MedCell Medical Company –

K.S.C. (closed)).

Related party transactions are subject to the Shareholders’ Annual General Assembly of the Parent Company.

25. Board of Directors recommendations and Shareholders’ Annual General Assembly of the parent company

The Board of Directors’ meeting held on February 19, 2024 recommended the following:

- Not to distribute dividends or bonus shares for the year ended December 31, 2023.

- Adding the following item to the agenda of the Shareholders’ Annual General Assembly of the parent company to

authorize the Board of Directors to distribute interim dividends (quarterly or semi-annually) to the Shareholders of

the Parent Company starting from the first interim financial statements of the Group following the completion of the

merger with First Dubai Real Estate Development Company:

• Discussing authorizing the Board of Directors to distribute interim dividends (semi-annually or quarterly) starting

from the first interim financial statements of the Group following the completion of the merger with First Dubai

Real Estate Development Company, and authorizing the board to determine the dividends rate, provided that

the distribution is from real profits in accordance with applicable accounting principles without impacting the

Company’s paid-up capital.

- Not to pay remuneration to the Board of Directors for the year ended December 31, 2023.

These recommendations are subject to the approval of the Shareholders’ General Assembly of the Parent Company.

The Annual General Meeting of the Shareholders held on March 16, 2023, has approved the consolidated financial

statements of the Group for the year ended December 31, 2022 and approved the following items:

• Not to distribute cash dividends or bonus shares for the year ended December 31, 2022.

• Not to pay Board of Directors remuneration for the year ended December 31, 2022.

• To offset the entire accumulated loss balance amounted to KD 9,095,362 as at December 31, 2022 against reducing

the balance of the share premium from KD 17,921,560 to KD 8,826,198.

The Parent Company’s Shareholders’ Extraordinary General Assembly meeting, held on June 13, 2023, had approved

the amendment of Article (57) of the Memorandum of Incorporation, and added a new Article (61) to the Memorandum

of Incorporation of the Parent Company regarding the mechanism of distributing interim dividends to shareholders,

which was notarized in the commercial registry on June 25, 2023.

51