Page 63 - Q4-2024-EN

P. 63

AL-MAZAYA HOLDING COMPANY - K.S.C. (PUBLIC)

AND ITS SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2023

(All amounts are in Kuwaiti Dinars)

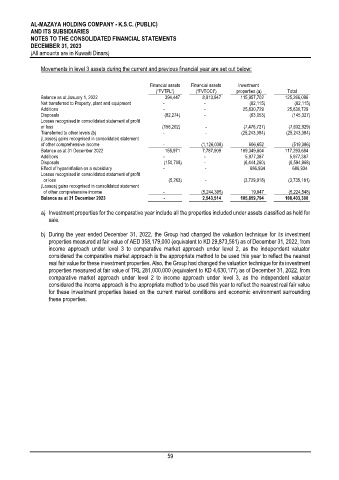

Movements in level 3 assets during the current and previous financial year are set out below:

Financial assets Financial assets Investment

(“FVTPL”) (“FVTOCI”) properties (a) Total

Balance as at January 1, 2022 394,447 8,913,947 115,957,702 125,266,096

Net transferred to Property, plant and equipment - - (62,115) (62,115)

Additions - - 25,630,729 25,630,729

Disposals (82,274) - (63,053) (145,327)

Losses recognised in consolidated statement of profit

or loss (156,202) - (7,476,727) (7,632,929)

Transferred to other levels (b) - - (25,243,384) (25,243,384)

(Losses) gains recognised in consolidated statement

of other comprehensive income - (1,126,038) 606,652 (519,386)

Balance as at 31 December 2022 155,971 7,787,909 109,349,804 117,293,684

Additions - - 5,977,387 5,977,387

Disposals (150,708) - (6,444,260) (6,594,968)

Effect of hyperinflation on a subsidiary - - 686,934 686,934

Losses recognised in consolidated statement of profit

or loss (5,263) - (3,729,918) (3,735,181)

(Losses) gains recognised in consolidated statement

of other comprehensive income - (5,244,395) 19,847 (5,224,548)

Balance as at 31 December 2023 - 2,543,514 105,859,794 108,403,308

a) Investment properties for the comparative year include all the properties included under assets classified as held for

sale.

b) During the year ended December 31, 2022, the Group had changed the valuation technique for its investment

properties measured at fair value of AED 358,179,000 (equivalent to KD 29,873,561) as of December 31, 2022, from

income approach under level 3 to comparative market approach under level 2, as the independent valuator

considered the comparative market approach is the appropriate method to be used this year to reflect the nearest

real fair value for these investment properties. Also, the Group had changed the valuation technique for its investment

properties measured at fair value of TRL 281,000,000 (equivalent to KD 4,630,177) as of December 31, 2022, from

comparative market approach under level 2 to income approach under level 3, as the independent valuator

considered the income approach is the appropriate method to be used this year to reflect the nearest real fair value

for these investment properties based on the current market conditions and economic environment surrounding

these properties.

59