Page 47 - Q4-2024-EN

P. 47

AL-MAZAYA HOLDING COMPANY - K.S.C. (PUBLIC)

AND ITS SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2023

(All amounts are in Kuwaiti Dinars)

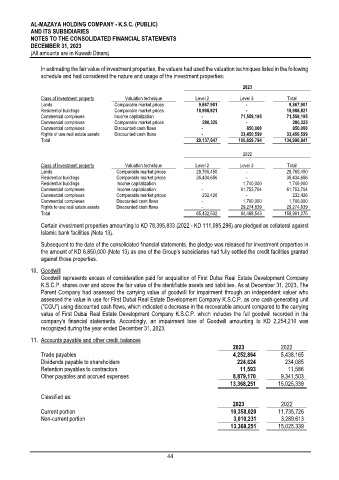

In estimating the fair value of investment properties, the valuers had used the valuation techniques listed in the following

schedule and had considered the nature and usage of the investment properties:

2023

Class of investment property Valuation technique Level 2 Level 3 Total

Lands Comparable market prices 9,867,901 - 9,867,901

Residential buildings Comparable market prices 18,988,821 - 18,988,821

Commercial complexes Income capitalization - 71,559,195 71,559,195

Commercial complexes Comparable market prices 280,325 - 280,325

Commercial complexes Discounted cash flows - 850,000 850,000

Rights of use real estate assets Discounted cash flows - 33,450,599 33,450,599

Total 29,137,047 105,859,794 134,996,841

2022

Class of investment property Valuation technique Level 2 Level 3 Total

Lands Comparable market prices 29,765,450 - 29,765,450

Residential buildings Comparable market prices 35,434,656 - 35,434,656

Residential buildings Income capitalization - 1,740,000 1,740,000

Commercial complexes Income capitalization - 61,753,704 61,753,704

Commercial complexes Comparable market prices 232,426 - 232,426

Commercial complexes Discounted cash flows - 1,700,000 1,700,000

Rights to use real estate assets Discounted cash flows - 29,274,839 29,274,839

Total 65,432,532 94,468,543 159,901,075

Certain investment properties amounting to KD 78,395,833 (2022 - KD 111,095,296) are pledged as collateral against

Islamic bank facilities (Note 13).

Subsequent to the date of the consolidated financial statements, the pledge was released for investment properties in

the amount of KD 6,850,000 (Note 13) as one of the Group’s subsidiaries had fully settled the credit facilities granted

against those properties.

10. Goodwill

Goodwill represents excess of consideration paid for acquisition of First Dubai Real Estate Development Company

K.S.C.P. shares over and above the fair value of the identifiable assets and liabilities. As at December 31, 2023, The

Parent Company had assessed the carrying value of goodwill for impairment through an independent valuer who

assessed the value in use for First Dubai Real Estate Development Company K.S.C.P. as one cash-generating unit

("CGU") using discounted cash flows, which indicated a decrease in the recoverable amount compared to the carrying

value of First Dubai Real Estate Development Company K.S.C.P. which includes the full goodwill recorded in the

company's financial statements. Accordingly, an impairment loss of Goodwill amounting to KD 2,254,210 was

recognized during the year ended December 31, 2023.

11. Accounts payable and other credit balances

2023 2022

Trade payables 4,252,864 5,438,165

Dividends payable to shareholders 224,624 234,085

Retention payables to contractors 11,593 11,586

Other payables and accrued expenses 8,879,170 9,341,503

13,368,251 15,025,339

Classified as:

2023 2022

Current portion 10,358,020 11,735,726

Non-current portion 3,010,231 3,289,613

13,368,251 15,025,339

44