Page 40 - Q4-2024-EN

P. 40

AL-MAZAYA HOLDING COMPANY - K.S.C. (PUBLIC)

AND ITS SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2023

(All amounts are in Kuwaiti Dinars)

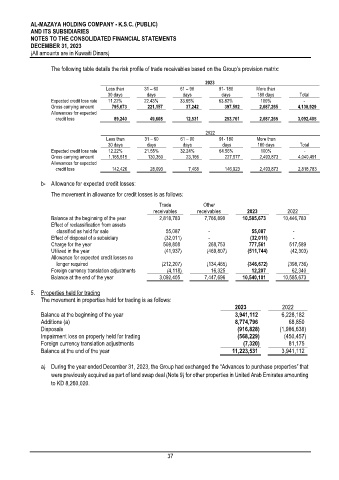

The following table details the risk profile of trade receivables based on the Group’s provision matrix:

2023

Less than 31 – 60 61 – 90 91- 180 More than

30 days days days days 180 days Total

Expected credit loss rate 11.22% 22.43% 33.65% 63.82% 100% -

Gross carrying amount 795,673 221,157 37,242 397,592 2,687,265 4,138,929

Allowances for expected

credit loss 89,240 49,608 12,531 253,761 2,687,265 3,092,405

2022

Less than 31 – 60 61 – 90 91- 180 More than

30 days days days days 180 days Total

Expected credit loss rate 12.22% 21.55% 32.24% 64.56% 100% -

Gross carrying amount 1,165,515 130,360 23,166 227,577 2,493,873 4,040,491

Allowances for expected

credit loss 142,426 28,093 7,468 146,923 2,493,873 2,818,783

b- Allowance for expected credit losses:

The movement in allowance for credit losses is as follows:

Trade Other

receivables receivables 2023 2022

Balance at the beginning of the year 2,818,783 7,766,890 10,585,673 10,446,783

Effect of reclassification from assets

classified as held for sale 55,087 - 55,087 -

Effect of disposal of a subsidiary (32,011) - (32,011) -

Charge for the year 508,808 268,753 777,561 517,589

Utilized in the year (41,937) (469,807) (511,744) (42,303)

Allowance for expected credit losses no

longer required (212,207) (134,465) (346,672) (398,736)

Foreign currency translation adjustments (4,118) 16,325 12,207 62,340

Balance at the end of the year 3,092,405 7,447,696 10,540,101 10,585,673

5. Properties held for trading

The movement in properties held for trading is as follows:

2023 2022

Balance at the beginning of the year 3,941,112 6,228,182

Additions (a) 8,774,796 68,850

Disposals (916,828) (1,986,638)

Impairment loss on property held for trading (568,229) (450,457)

Foreign currency translation adjustments (7,320) 81,175

Balance at the end of the year 11,223,531 3,941,112

a) During the year ended December 31, 2023, the Group had exchanged the “Advances to purchase properties” that

were previously acquired as part of land swap deal (Note 9) for other properties in United Arab Emirates amounting

to KD 8,260,020.

37