N

otes To The Consolidated Financial Statements

AL MAZAYA HOLDING K.S.C.P. AND ITS SUBSIDIARIES

As At 31 December 2016

ANNUAL REPORT

2016

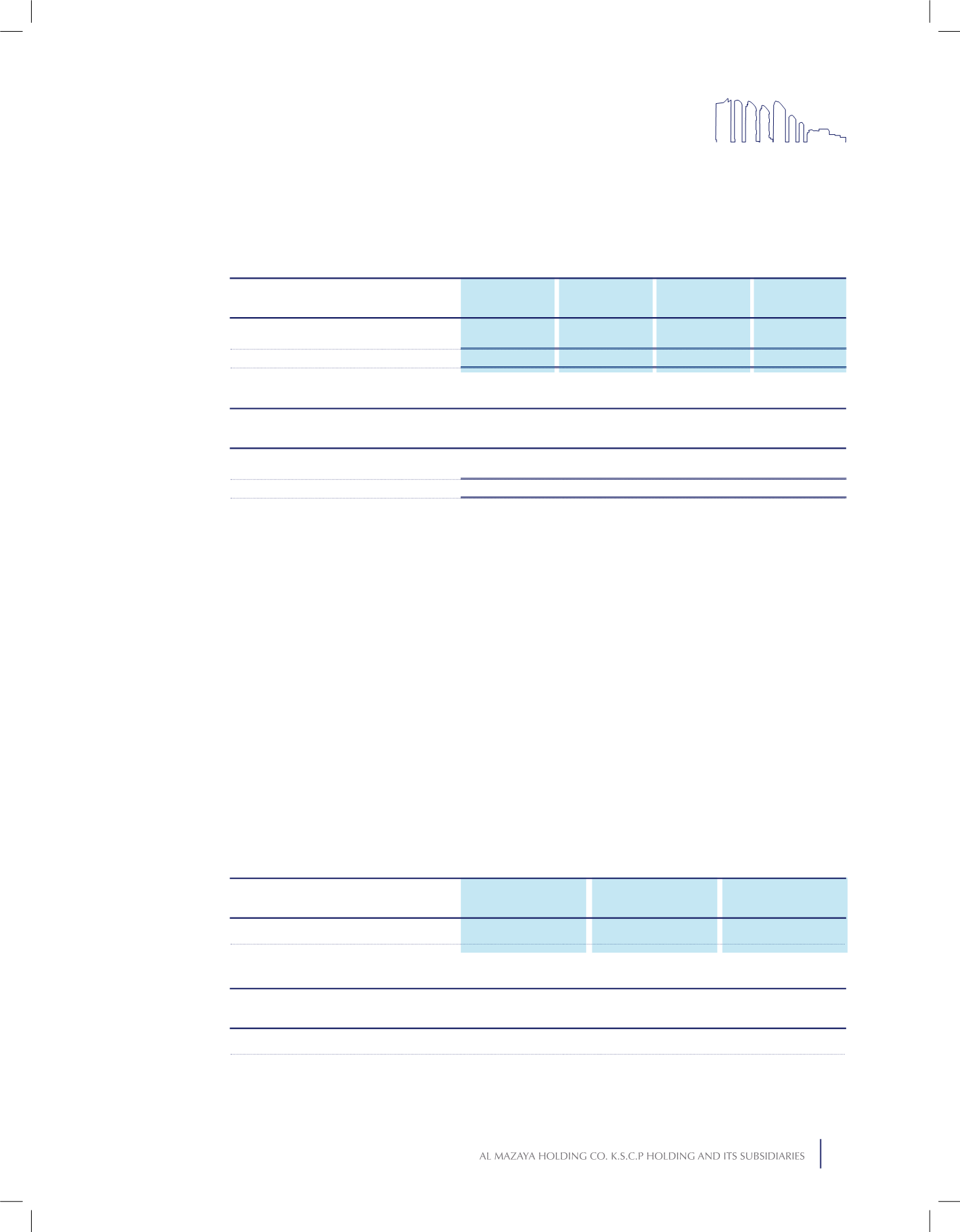

ii) Secondary segment information:

Residential

KD

Level 1

KD

Level 1

KD

Level 3

KD

Level 2

KD

Total

KD

Total

KD

Residential

KD

Commercial

KD

Commercial

KD

Total segment revenue

Total segment assets

Financial assets available-for-sale

Financial assets available-for-sale

Total segment revenue

Total segment assets

Others

KD

Others

KD

Total

KD

Total

KD

49,708,896

106,262,865

60,013

2,022,930

7,203,068

7,146,012

7,263,081

9,168,942

55,308,046

121,397,261

5,463,329

92,060,368

4,510,313

62,262,456

-

56,460,712

-

67,381,970

55,172,225

254,783,945

59,818,359

251,041,687

2016

2016

2015

2015

28. CAPITAL COMMITMENTS

The Group has concluded construction contracts with third parties and is consequently committed to future capital

expenditure in respect of properties under construction amounting to KD 13,191,774 (2015: KD 13,234,883).

The Group has commitments amounting to KD 5,218,925 (2015: KD 7,250,671) to purchase land from a

third party.

29. FAIR VALUES MEASUREMENT

Financial instruments comprise financial assets and financial liabilities

The fair value of financial assets and financial liabilities that are not carried at fair value is not materially

different from their carrying amounts.

The methodologies and assumptions used to determine fair values of assets is described in fair value section

of Note 4: Significant Accounting Policies.

Financial instruments

The Group held the following financial instruments available-for-sale that are fair valued at the reporting date

in the consolidated statement of financial position:

Certain unquoted investments with carrying value of KD 1,863,879 (31 December 2015: KD 1,952,600) are

carried at cost less impairment losses.

119