N

otes To The Consolidated Financial Statements

AL MAZAYA HOLDING K.S.C.P. AND ITS SUBSIDIARIES

As At 31 December 2016

ANNUAL REPORT

2016

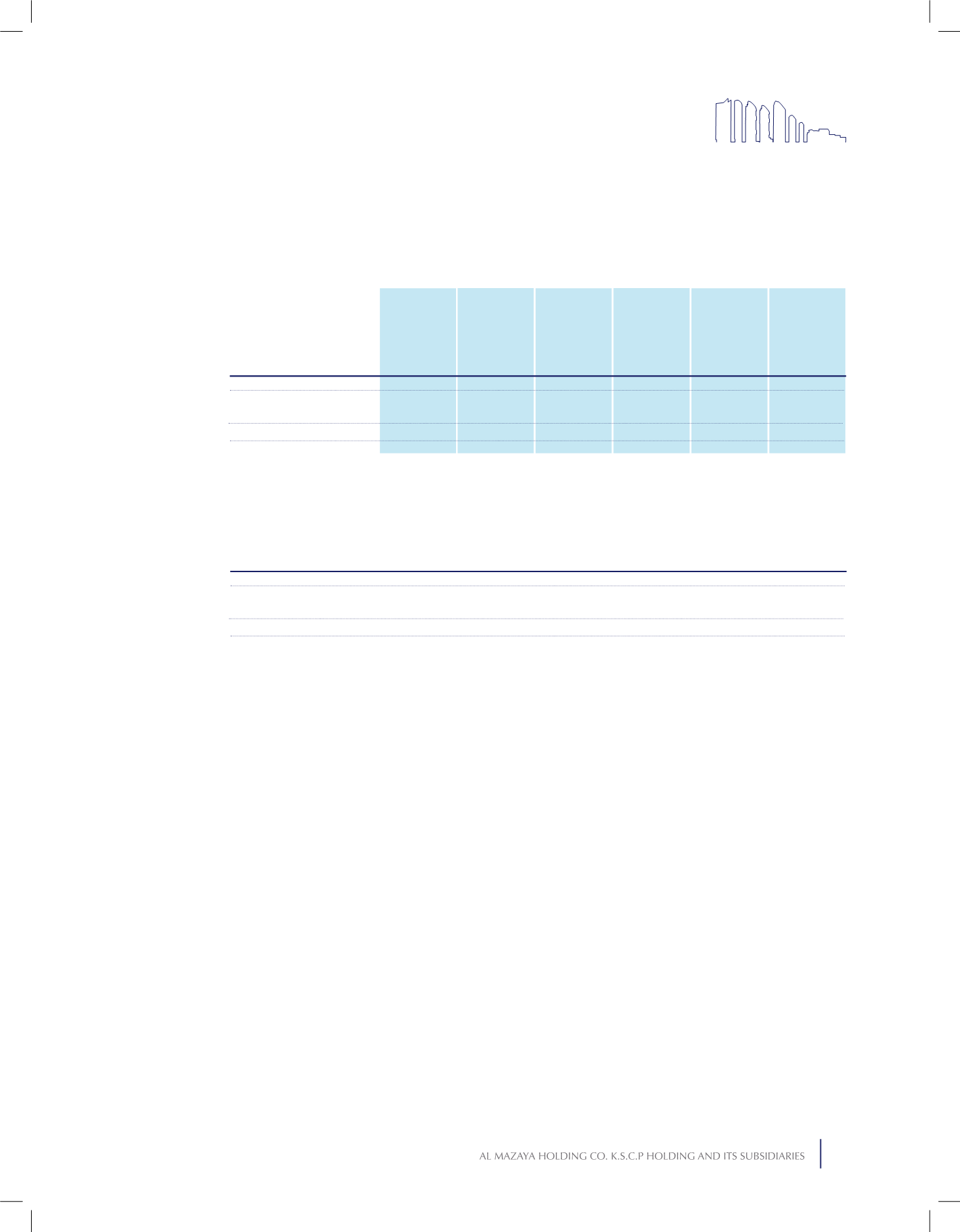

The following table shows a reconciliation of the opening and closing amount of level 3 non-financial assets which

are recorded at fair value:

Fair value of investment propertieswere determined using sales comparison approach and income capitalisation

approach. The fair valuation conducted by valuators considering transaction prices of the property and similar

properties in case of sales comparison approach and the significant unobservable valuation input used is the

market price per square foot and varies from property to property. A reasonable change in this input would

result in an equivalent amount of change in fair value.

Capitalisation of rental income method assumes capitalisation of annual rental income and the significant

unobservable valuation input used is the capitalisation rate in the range of 5.8% to 9.5% (2015: 5.8% to 7%).

A 5% increase in this input would result in an equivalent decrease in fair value.

Certain investment properties owned by the Group on Build Operate and Transfer (BOT) basis are valued

using discounted cash flow method.

At 1 January

2016

KD

At 1 January

2015

KD

Reclassification

from level 2 to

level 3

KD

Loss

recorded in the

consolidated

statement of

income

KD

Gain

recorded in the

consolidated

statement of

income

KD

Gain recorded

in other

comprehensive

income

KD

Gain recorded

in other

comprehensive

income

KD

Net purchases,

sales and

settlements

KD

Net purchases,

sales and

settlements

KD

At

31 December

2016

KD

At

31 December

2015

KD

Investment properties

Investment properties

64,452,915

50,498,006

31,463,371 )603,427(

423,536

472,064

1,872,348

12,528,106

11,659,025

108,313,029

64,452,915

121