N

otes To The Consolidated Financial Statements

AL MAZAYA HOLDING K.S.C.P. AND ITS SUBSIDIARIES

As At 31 December 2016

ANNUAL REPORT

2016

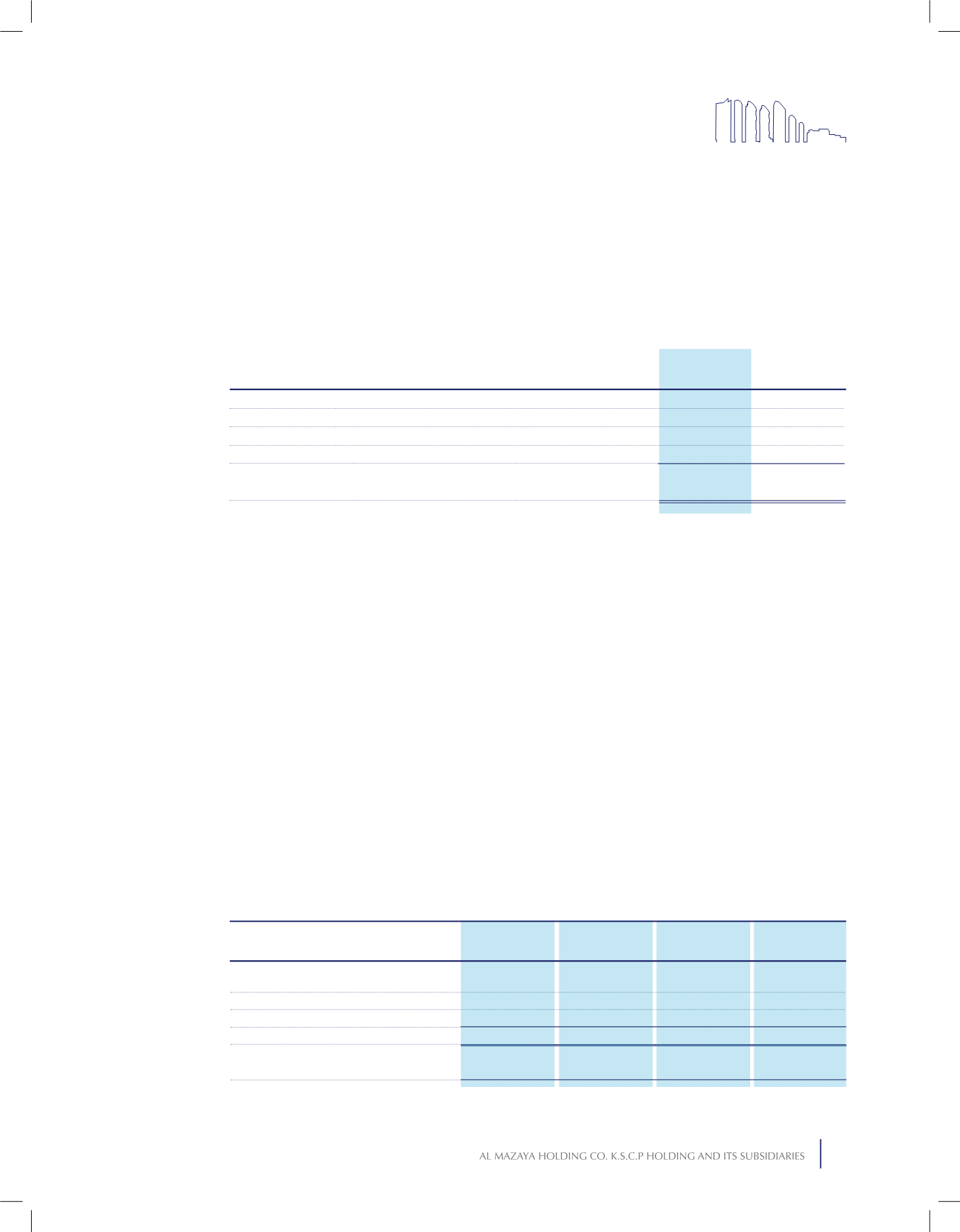

30.1.1 Gross maximum exposure to credit risk

The table below shows the gross maximum exposure to credit risk across the Group’s financial assets.

Financial assets of the Group subject to credit risk are distributed over the following geographical regions:

The Group’s exposure relates predominately to real estate and construction sectors.

There is no concentration of credit risk with respect to real estate receivables, as the Group has a large number of

tenants.

30.1.2 Credit quality of financial assets that are neither past due nor impaired

The Group neither uses internal credit grading system nor external credit grades. The Group manages credit quality

by ensuring that credit is granted only to known creditworthy parties.

30.1.3 Past due and impaired

The Group does not have any past due but not impaired financial assets as at 31 December 2016 and 2015.

Kuwait

UAE

Turkey

Other

4,739,049

11,646,745

9,101,695

1,336,057

26,823,546

7,511,877

13,025,378

-

7,645

20,544,900

2016

KD

2015

KD

30.2 Liquidity risk

Liquidity risk is the risk that the Group will be unable to meet its liabilities when they fall due. To limit this

risk, management has arranged diversified funding sources, manages assets with liquidity in mind, and monitors

liquidity on a daily basis.

The Group’s objective is to maintain a balance between continuity of funding and flexibility through the use of

bank deposits and facilities.

The table below summarises the maturity profile of the Group’s financial liabilities based on contractual

undiscounted repayment obligations. The liquidity profile of financial liabilities reflects the projected cash flows

which includes future finance cost payments over the life of these financial liabilities.

Within

1 year KD

12- years

KD

Term Loans

Tawarruq and ijara payable

Accounts payable and other credit balances

Total undiscounted liabilities

Capital commitments

Over 2

years KD

Total

KD

2,912,234

13,641,941

13,585,304

30,139,479

3,682,140

1,870,280

15,912,055

3,217,127

20,999,462

4,602,675

6,779,524

59,427,931

3,073,984

69,281,439

10,125,884

11,562,038

88,981,927

19,876,415

120,420,380

18,410,699

31 December 2016

123